Your Fannie mae self employed income worksheet fillable images are ready in this website. Fannie mae self employed income worksheet fillable are a topic that is being searched for and liked by netizens now. You can Find and Download the Fannie mae self employed income worksheet fillable files here. Find and Download all royalty-free photos and vectors.

If you’re searching for fannie mae self employed income worksheet fillable images information related to the fannie mae self employed income worksheet fillable topic, you have come to the right site. Our site frequently gives you suggestions for seeing the maximum quality video and picture content, please kindly surf and find more enlightening video content and images that match your interests.

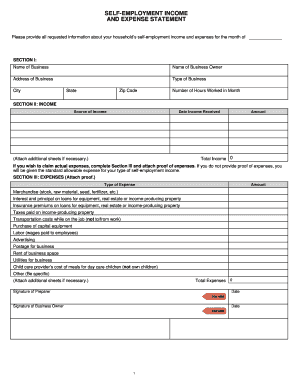

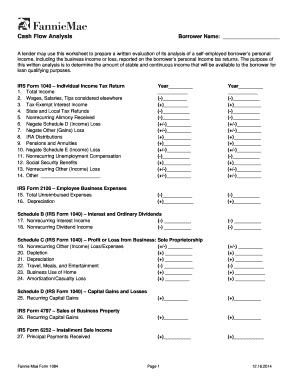

Fannie Mae Self Employed Income Worksheet Fillable. W-2 Income from Self-Employment. The purpose of this written analysis is to determine the amount of stable and continuous income that will be available to the borrower for loan qualifying purposes. Please note that these tools offer suggested guidance they dont replace instructions or. 1 They do not work for 99 of employed borrowers.

Fannie Mae Income Calculation Worksheet Fill Online Printable Fillable Blank Pdffiller From fannie-mae-income-worksheet.pdffiller.com

Fannie Mae Income Calculation Worksheet Fill Online Printable Fillable Blank Pdffiller From fannie-mae-income-worksheet.pdffiller.com

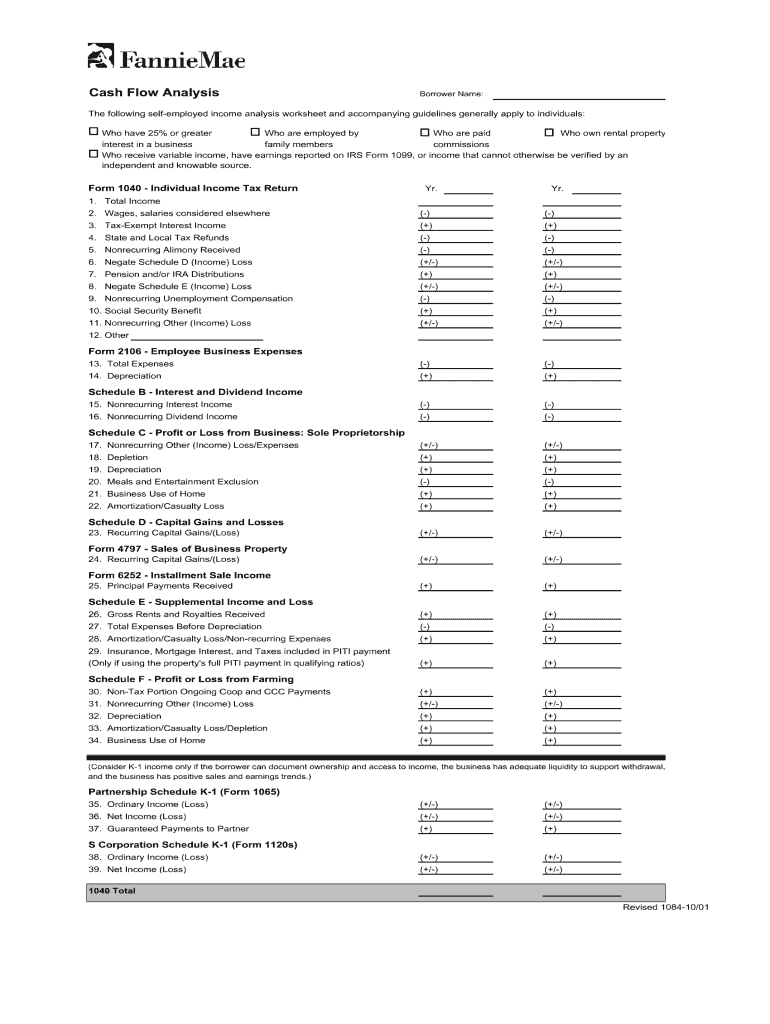

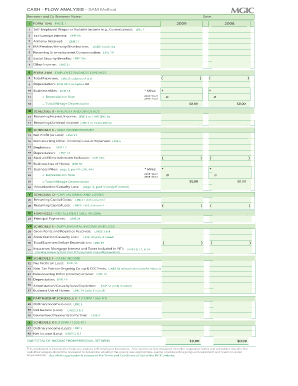

If the borrower is the business owner or is self-employed and has an ownership share of 25 or more the self-employment indicator must be checked. The way to complete the Self employed income analysis worksheet form online. Confirming the tax returns reflect at least 12 months of self-employment income and completing Fannie Maes Cash Flow Analysis Form 1084 or any other type of cash flow analysis form that applies the same principles. 9 days ago FANNIEMAESELFEMPLOYEDINCOMEWORKSHEET calculating qualifying rental income for Fannie Mae fillable Fannie Mae 1038. The net income from self-employment must be entered in the Base Income field in Section V. IRS Form 1040 Individual Income Tax Return.

The following self employed income analysis worksheet and accompanying guidelines generally apply to individuals For example.

Who have 25 or greater interest in a business. B3-3 2-01 Underwriting Factors And Documentation for a Self-Employed Borrower 040913. Fannie Mae Cash Flow Analysis. The net income from self-employment must be entered in the Base Income field in Section V. The purpose of this written analysis is to determine the amount of stable and continuous income that will be available to the borrower for loan qualifying purposes. Determine the percentage change in taxable income from one year.

Source: pdffiller.com

Source: pdffiller.com

The purpose of this written analysis is to determine the amount of stable and continuous income that will be available to the borrower for loan qualifying purposes. Self-Employed Borrower Tools by Enact MI. We get it mental math is hard. Please note that these tools offer suggested guidance they dont replace instructions or. 1 They do not work for 99 of employed borrowers.

Source: pdffiller.com

Source: pdffiller.com

1 They do not work for 99 of employed borrowers. This self-employed income analysis and the included descriptions generally apply to individuals. Type all necessary information in the required fillable areas. Thats why Enact provides a collection of downloadable calculators and reference guides to help you analyze a self-employed borrowers average monthly income and expenses. Who have 25 or greater Who are employed by Who are paid Who own rental property interest in a business family members commissions Who receive variable income have earnings reported on IRS Form 1099 or income that cannot otherwise be verified by an independent and.

Source: mortgagemark.com

Source: mortgagemark.com

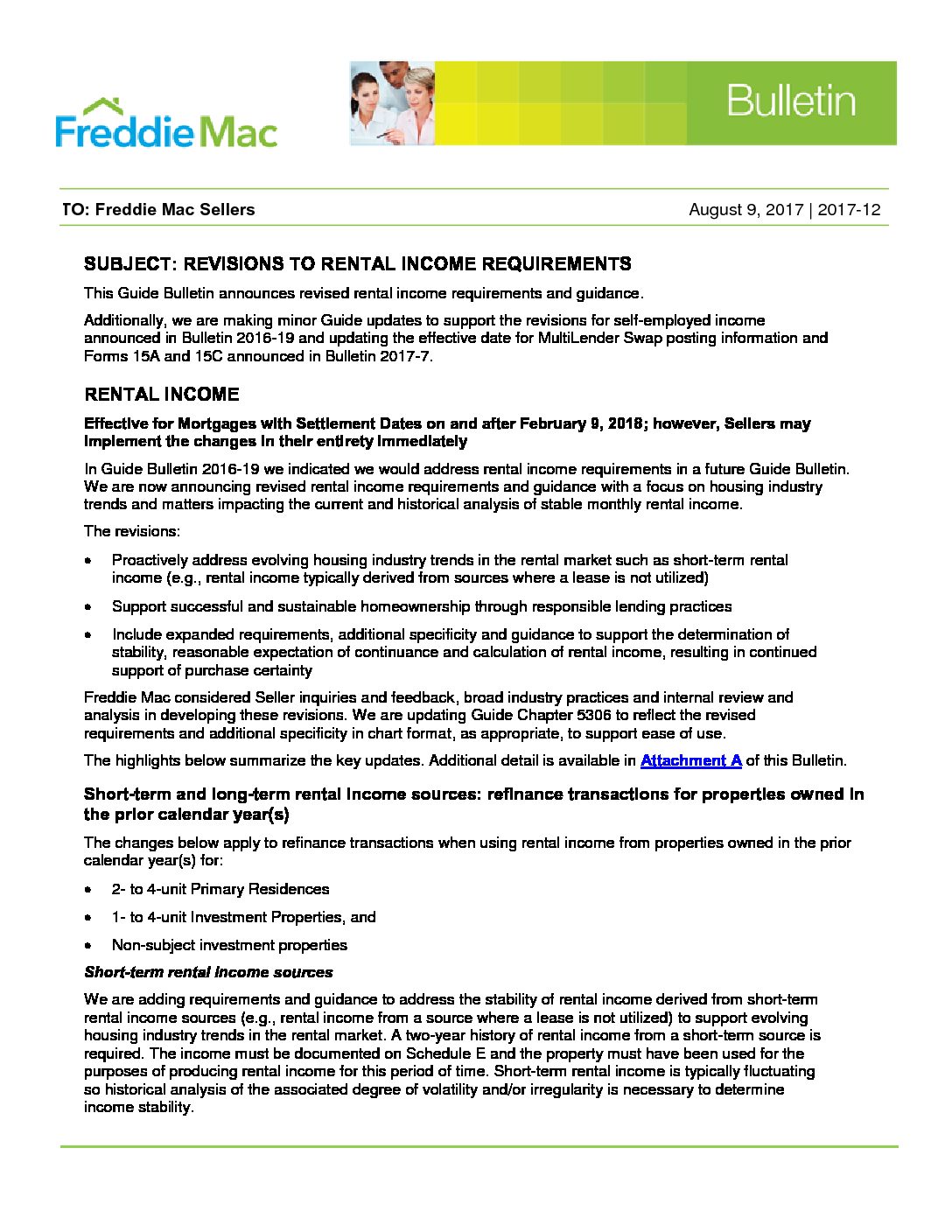

6 days ago Self employed income worksheet fannie mae. A lender may use fannie mae rental income worksheets form 1037 or form 1038 or a comparable. Fill Online Printable Fillable Blank Fannie Mae Cash Flow Analysis Genworth Form Use Fill to complete blank online GENWORTH pdf forms for free. Monthly Qualifying Rental Income. Thats why Enact provides a collection of downloadable calculators and reference guides to help you analyze a self-employed borrowers average monthly income and expenses.

Source:

Please use the following quick reference guide to assist you in completing Fannie Mae Form 1084. How you can complete the Fannie mae income calculation worksheet editable form online. Analyze self-employed borrower cash flow income from employment and non-employment sources and rental income using our editable auto-calculating worksheets. 1 They do not work for 99 of employed borrowers. Who have 25 or greater Who are employed by Who are paid Who own rental property interest in a business family members commissions Who receive variable income have earnings reported on IRS Form 1099 or income that cannot otherwise be verified by an independent and.

Source: pdffiller.com

Source: pdffiller.com

DU will consider the borrower self-employed. Who have 25 or greater Who are employed by Who are paid Who own rental property interest in a business family members commissions Who receive variable income have earnings reported on IRS Form 1099 or income that cannot otherwise be verified by an independent and. Form 1003 705 rev. The net income from self-employment must be entered in the Base Income field in Section V. Pick the web sample from the catalogue.

Source: uslegalforms.com

Source: uslegalforms.com

Pick the web sample from the catalogue. To estimate and analyze a borrowers cash. Alender may use this worksheet to prepare a written evaluation of its analysis of a self-employed borrowers personal income including the business income or loss reported on the borrowers personal income tax returns. Schedule E IRS Form 1040 OR Lease Agreement or Fannie Mae Form 1025 Address of Principal Residence. Fill Online Printable Fillable Blank Fannie Mae Cash Flow Analysis Genworth Form Use Fill to complete blank online GENWORTH pdf forms for free.

Source: self-employed-income-analysis.pdffiller.com

Source: self-employed-income-analysis.pdffiller.com

Cash flow analysis worksheets tax year 2020 Self-employed SAM Cash Flow Analysis with PL 02192021 Download the worksheet. This form is a tool to help the Seller calculate the income for a self-employed Borrower. The following self employed income analysis worksheet and accompanying guidelines generally apply to individuals For example. Confirming the tax returns reflect at least 12 months of self-employment income and completing Fannie Maes Cash Flow Analysis Form 1084 or any other type of cash flow analysis form that applies the same principles. A lender may use fannie mae rental income worksheets form 1037 or form 1038 or a comparable.

Source: fannie-mae-1037.pdffiller.com

Source: fannie-mae-1037.pdffiller.com

This form is a tool to help the Seller calculate the income for a self-employed Borrower. Who have 25 or greater interest in a business. The user-friendly dragdrop user interface makes it easy to add or relocate fields. Form 1003 705 rev. The net income from self-employment must be entered in the Base Income field in Section V.

Source: pinterest.com

Source: pinterest.com

IRS Form 1040 Individual Income Tax Return Year_____ Year_____ 1. Comply with our simple actions to have your Fannie Mae 1084 prepared quickly. Please use the following quick reference guide to assist you in completing Fannie Mae Form 1084. The advanced tools of the editor will direct you through the editable PDF template. The purpose of this written analysis is to determine the amount of stable and continuous income that will be available to the borrower for loan qualifying purposes.

Source:

Calculator and Quick Reference Guide. The advanced tools of the editor will direct you through the editable PDF template. Determine what percentage taxable income is of gross income by dividing the dollar amount of taxable income by the dollar amount of gross income. If the borrower is the business owner or is self-employed and has an ownership share of 25 or more the self-employment indicator must be checked. The way to complete the Self employed income analysis worksheet form online.

Source: nidecmege.blogspot.com

Source: nidecmege.blogspot.com

We get it mental math is hard. 9 days ago FANNIEMAESELFEMPLOYEDINCOMEWORKSHEET calculating qualifying rental income for Fannie Mae fillable Fannie Mae 1038. To start the document use the Fill Sign Online button or tick the preview image of the form. Determine what percentage taxable income is of gross income by dividing the dollar amount of taxable income by the dollar amount of gross income. W-2 Income from Self-Employment.

Source: nidecmege.blogspot.com

Source: nidecmege.blogspot.com

Fannie Mae Cash Flow Analysis. Suggested guidance only and does not replace Fannie Mae instructions or applicable guidelines. Type all necessary information in the required fillable areas. Fannie Mae Form 1037 09302014 Refer to the Rental Income topic in the Selling Guide for additional guidance. Who have 25 or greater Who are employed by Who are paid Who own rental property interest in a business family members commissions Who receive variable income have earnings reported on IRS Form 1099 or income that cannot otherwise be verified by an independent and.

Source: pdffiller.com

Source: pdffiller.com

This form is a tool to help the Seller calculate the income for a self-employed Borrower. 6 days ago Self employed income worksheet fannie mae. Who have 25 or greater interest in a business. The purpose of this written analysis is to determine the amount of stable and continuous income that will be available to the borrower for loan qualifying purposes. Analyze self-employed borrower cash flow income from employment and non-employment sources and rental income using our editable auto-calculating worksheets.

Source: pdffiller.com

Source: pdffiller.com

Who have 25 or greater Who are employed by Who are paid Who own rental property interest in a business family members commissions Who receive variable income have earnings reported on IRS Form 1099 or income that cannot otherwise be verified by an independent and. To estimate and analyze a borrowers cash. Fill Online Printable Fillable Blank Fannie Mae Cash Flow Analysis Genworth Form Use Fill to complete blank online GENWORTH pdf forms for free. The user-friendly dragdrop user interface makes it easy to add or relocate fields. Enter the results where indicated.

Source: pdfrun.com

Source: pdfrun.com

Comply with our simple actions to have your Fannie Mae 1084 prepared quickly. A lender may use fannie mae rental income worksheets form 1037 or form 1038 or a comparable. Once completed you can sign your fillable form or send for signing. Confirming the tax returns reflect at least 12 months of self-employment income and completing Fannie Maes Cash Flow Analysis Form 1084 or any other type of cash flow analysis form that applies the same principles. How you can complete the Fannie mae income calculation worksheet editable form online.

Source: fannie-mae-income-worksheet.pdffiller.com

Source: fannie-mae-income-worksheet.pdffiller.com

A lender may use fannie mae rental income worksheets form 1037 or form 1038 or a comparable. Fill Online Printable Fillable Blank Fannie Mae Cash Flow Analysis Genworth Form Use Fill to complete blank online GENWORTH pdf forms for free. To start the document use the Fill Sign Online button or tick the preview image of the form. Thats why Enact provides a collection of downloadable calculators and reference guides to help you analyze a self-employed borrowers average monthly income and expenses. W-2 Income from Self-Employment.

Source: pdffiller.com

Source: pdffiller.com

The purpose of this written analysis is to determine the amount of stable and continuous income that will be available to the borrower for loan qualifying purposes. This self-employed income analysis and the included descriptions generally apply to individuals. Comply with our simple actions to have your Fannie Mae 1084 prepared quickly. Form 91 is to be used to document the Sellers calculation of the income for a self-employed Borrower. Fannie Mae Cash Flow Analysis.

Source: pinterest.com

Source: pinterest.com

Suggested guidance only and does not replace Fannie Mae instructions or applicable guidelines. The Sellers calculations must be based on the requirements and guidance for the determination of stable monthly income in Topic 5300. Please use the following quick reference guide to assist you in completing Fannie Mae Form 1084. Who have 25 or greater Who are employed by Who are paid Who own rental property interest in a business family members commissions Who receive variable income have earnings reported on IRS Form 1099 or income that cannot otherwise be verified by an independent and. Enter the results where indicated.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title fannie mae self employed income worksheet fillable by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.