Your Fannie mae cash flow analysis worksheet images are ready in this website. Fannie mae cash flow analysis worksheet are a topic that is being searched for and liked by netizens today. You can Find and Download the Fannie mae cash flow analysis worksheet files here. Download all free photos and vectors.

If you’re searching for fannie mae cash flow analysis worksheet pictures information related to the fannie mae cash flow analysis worksheet keyword, you have come to the ideal blog. Our site frequently provides you with suggestions for viewing the highest quality video and image content, please kindly hunt and find more enlightening video articles and images that fit your interests.

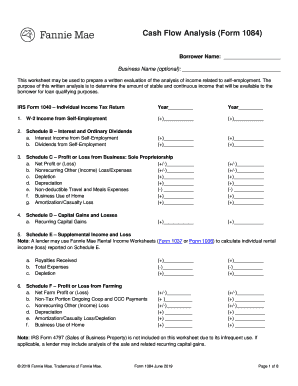

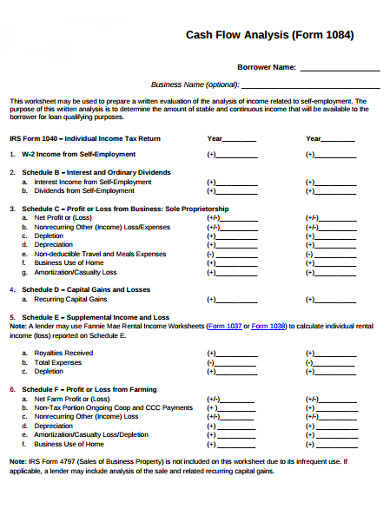

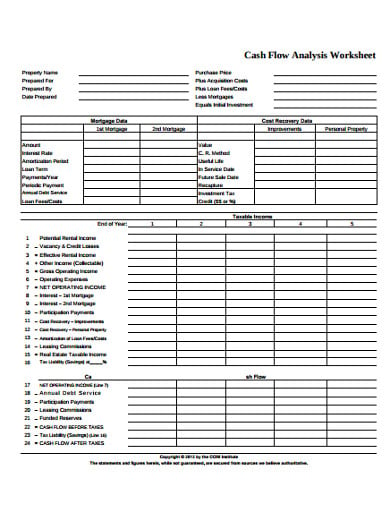

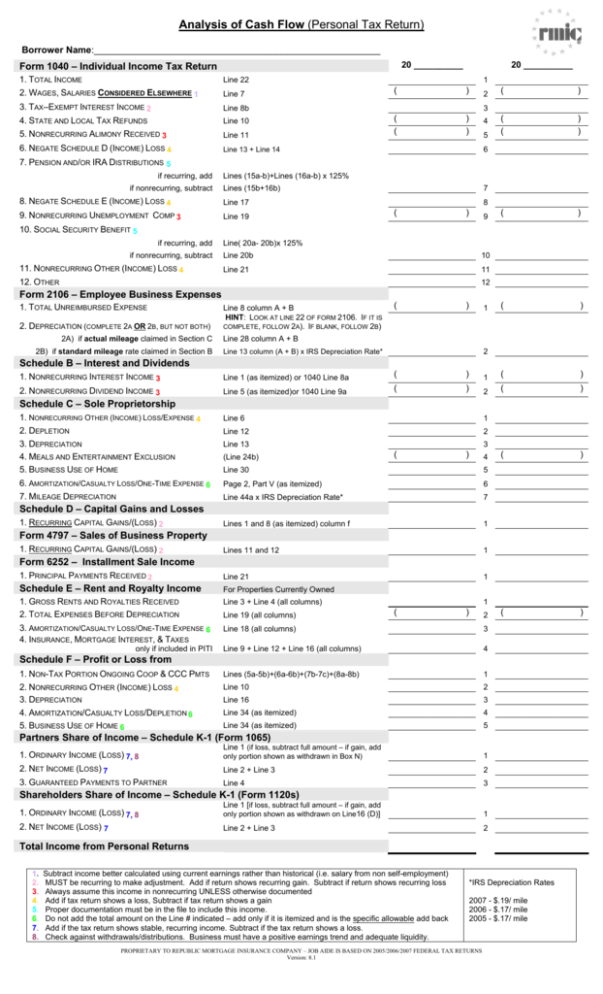

Fannie Mae Cash Flow Analysis Worksheet. Cash flow analysis worksheets for tax year 2020 Our cash flow analysis worksheets help you to easily and accurately determine a self-employed borrowers income. The Fannie Mae Cash Flow Analysis form is 4 pages long and. Schedule Analysis Method SAM Calculator 2019-2020 Calculate qualifying. Cash Flow Analysis CalculatorL21L22 Cash Flow Analysis CalculatorF21 Cash Flow Analysis CalculatorF37 Cash Flow Analysis CalculatorL37 Excel 97-2003 A value must be entered in each cell to correctly calculate income.

Get Our Image Of Real Estate Investment Analysis Template Investment Analysis Income Property Statement Template From pinterest.com

Get Our Image Of Real Estate Investment Analysis Template Investment Analysis Income Property Statement Template From pinterest.com

Fill Online Printable Fillable Blank Fannie Mae Cash Flow Analysis Genworth Form Use Fill to complete blank online GENWORTH pdf forms for free. Line by line explanations are displayed by hovering the cursor over the help buttons at the beginning of each line. Fannie Mae Cash Flow Analysis. Guidance for documenting access to income and business liquidity If the Schedule K-1 reflects a documented stable history of receiving cash distributions of income from the business consistent with the level of business income being used to qualify then no further documentation of access to income or adequate business liquidity to. The borrower can document The. The following sources of income may be considered for qualification provided.

Using tax returns and P.

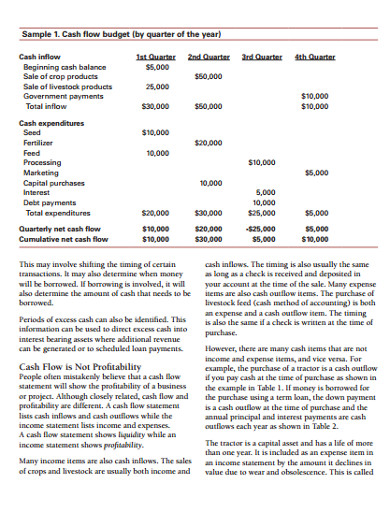

Cash Flow Analysis CalculatorL21L22 Cash Flow Analysis CalculatorF21 Cash Flow Analysis CalculatorF37 Cash Flow Analysis CalculatorL37 Excel 97-2003 A value must be entered in each cell to correctly calculate income. The Fannie Mae Cash Flow Analysis form is 4 pages long and. All forms are printable and downloadable. Once completed you can sign your fillable form or send for signing. ProcessingUnderwritingClosing Forms Processing Underwriting and Closing Forms Page 2 of 3. To estimate and analyze a borrowers cash flow situation enter the required data into the cash flow analysis calculator according to the calculations that appear on the borrowers tax returns.

Source: pinterest.com

Source: pinterest.com

Cash flow analysis worksheets for tax year 2020 Our cash flow analysis worksheets help you to easily and accurately determine a self-employed borrowers income. IRS Form 1040 Individual Income Tax Return. Cash Flow Analysis CalculatorL21L22 Cash Flow Analysis CalculatorF21 Cash Flow Analysis CalculatorF37 Cash Flow Analysis CalculatorL37 Excel 97-2003 A value must be entered in each cell to correctly calculate income. Cash Flow Analysis Borrower Name. Line by line explanations are displayed by hovering the cursor over the help buttons at the beginning of each line.

Source: pdffiller.com

Source: pdffiller.com

Summary section in SAM auto-fills income loss. Applicant lenders must still conduct an analysis of the business tax returns to ensure a consistent pattern of profitablity. Interest Income from Self-Employment Line 1 b. Once completed you can sign your fillable form or send for signing. Freddie Mac Form 91 Calculator 2019-2020 Quick reference guide and income analysis for Freddie Mac Form 91 updated.

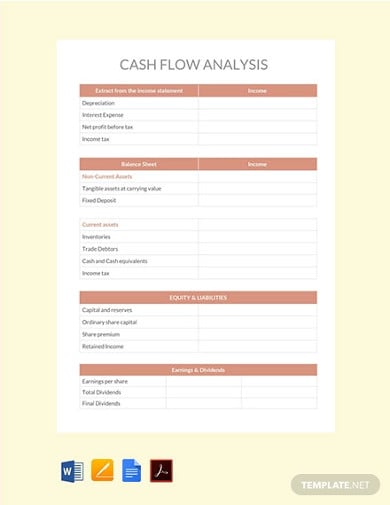

Source: template.net

Source: template.net

Calculate and analyze cash flow to help you complete Fannie Mae form 1084. The borrower can document The. Any loss resulting from this analysis must be deducted from cash flow as it represents a drain on the borrowers income. Cash Flow Analysis Borrower Name. All forms are printable and downloadable.

Source: pinterest.com

Source: pinterest.com

Dividends from Self-Employment Line 5 3. The Fannie Mae Cash Flow Analysis form is 4 pages long and. Once completed you can sign your fillable form or send for signing. Cash flow analysis worksheets for tax year 2020 Our cash flow analysis worksheets help you to easily and accurately determine a self-employed borrowers income. When the borrower has 25 or more ownership interest in the business and business tax returns are required the lender must perform a business cash flow analysis and evaluate the overall financial position of the borrowers business to determine whether income is stable and consistent and sales and earnings trends are positive.

Source: pdffiller.com

Source: pdffiller.com

Cash flow analysis worksheets for tax year 2020 Our cash flow analysis worksheets help you to easily and accurately determine a self-employed borrowers income. ProcessingUnderwritingClosing Forms Processing Underwriting and Closing Forms Page 2 of 3. Cash flow and YTD profit and loss PL. Summary section in SAM auto-fills income loss. To estimate and analyze a borrowers cash flow situation enter the required data into the cash flow analysis calculator according to the calculations that appear on the borrowers tax returns.

Source: template.net

Source: template.net

This worksheet may be used to prepare a written evaluation of the analysis of income related to self-employment. Fill Online Printable Fillable Blank Fannie Mae Cash Flow Analysis Form. Our editable auto-calculating worksheets help you to analyze. Interest Income from Self-Employment Line 1 b. Dividends from Self-Employment Line 5 3.

Source: pinterest.com

Source: pinterest.com

Schedule B Interest and Ordinary Dividends a. Our editable auto-calculating worksheets help you to analyze. Freddie Mac Form 92 Calculator 2019-2020 Form 92 Net Rental Income Calculations Schedule E updated. IRS Form 1040 Individual Income Tax Return. CASH FLOW ANALYSIS Fannie Mae Form 1084 Instructions IRS Form 1040 Individual Income Tax Return Line 1 - Total Income.

Source: pinterest.com

Source: pinterest.com

On average this form takes 39 minutes to complete. IRS Form 1040 Individual Income Tax Return. Fannie Mae Cash Flow Analysis. Schedule Analysis Method SAM Calculator 2019-2020 Calculate qualifying. These data validation rules will not be saved.

Source: studylib.net

Source: studylib.net

Calculate and analyze cash flow to help you complete Fannie Mae form 1084. Some of the worksheets for this concept are 2019 shareholders instructions for schedule k 1 form 1120 s Income tax return for an s corporation omb 1545 Us 1120s line 19 2018 form 1120 w work Fannie mae cash flow analysis calculator Form 91 income calculations calculator Partners adjusted basis work outside basis tax Drake software users manual. Fannie Mae Cash Flow Analysis. Fannie Mae Cash Flow Analysis. IRS Form 1040 Individual Income Tax Return.

Source: id.pinterest.com

Source: id.pinterest.com

Cash flow analysis worksheets for tax year 2020 Our cash flow analysis worksheets help you to easily and accurately determine a self-employed borrowers income. Cash flow and YTD profit and loss PL. This worksheet may be used to prepare a written evaluation of the analysis of income related to self-employment. Cash Flow Analysis CalculatorL21L22 Cash Flow Analysis CalculatorF21 Cash Flow Analysis CalculatorF37 Cash Flow Analysis CalculatorL37 Excel 97-2003 A value must be entered in each cell to correctly calculate income. Freddie Mac Form 91 Calculator 2019-2020 Quick reference guide and income analysis for Freddie Mac Form 91 updated.

Source: pinterest.com

Source: pinterest.com

Cash flow analysis worksheets tax year 2020 Self-employed SAM Cash Flow Analysis with PL 02192021 Download the worksheet. Fill Online Printable Fillable Blank Fannie Mae Cash Flow Analysis Genworth Form Use Fill to complete blank online GENWORTH pdf forms for free. Fannie Mae Cash Flow Analysis. This worksheet may be used to prepare a written evaluation of the analysis of income related to self-employment. FNMA B3-321-08 If there is a stable history of receiving the distribution amount consistent with the level of business income needed to qualify then enter this amount on the worksheet and NO further documentation is required to include the income in the borrowers cash flow OR.

Source: template.net

Source: template.net

Cash flow analysis worksheets for tax year 2020 Our cash flow analysis worksheets help you to easily and accurately determine a self-employed borrowers income. Summary section in SAM auto-fills income loss. IRS Form 1040 Individual Income Tax Return. These data validation rules will not be saved. IRS Form 1040 Individual Income Tax Return.

Source: pinterest.com

Source: pinterest.com

IRS Form 1040 Individual Income Tax Return. Our editable auto-calculating worksheets help you to analyze. This worksheet may be used to prepare a written evaluation of the analysis of income related to self-employment. Schedule B Interest and Ordinary Dividends a. Once completed you can sign your fillable form or send for signing.

Source: cash-flow-analysis-form.pdffiller.com

Source: cash-flow-analysis-form.pdffiller.com

IRS Form 1040 Individual Income Tax Return. Guidance for documenting access to income and business liquidity If the Schedule K-1 reflects a documented stable history of receiving cash distributions of income from the business consistent with the level of business income being used to qualify then no further documentation of access to income or adequate business liquidity to. Some of the worksheets displayed are 1120 s income tax return for an s corporation 2020 instructions for form 1120 s Fannie mae cash flow analysis calculator Financial aid application work 1 2019 2020 school year Income calculations Fnma self employed income Form 91 income calculator Sam method cash flow analysis work mgic. The following sources of income may be considered for qualification provided. Interest Income from Self-Employment Line 1 b.

Source: pinterest.com

Source: pinterest.com

Some of the worksheets displayed are 1120 s income tax return for an s corporation 2020 instructions for form 1120 s Fannie mae cash flow analysis calculator Financial aid application work 1 2019 2020 school year Income calculations Fnma self employed income Form 91 income calculator Sam method cash flow analysis work mgic. The borrower can document The. Line by line explanations are displayed by hovering the cursor over the help buttons at the beginning of each line. Dividends from Self-Employment Line 5 3. Some of the worksheets for this concept are Schedule a 1120 s income tax return for an s corporation 2019 form 1120 Fannie mae cash flow analysis calculator C corporation organizer S corporation shareholders adjusted basis work 2019 ia 1120s income tax return for s corporations Instructions for 1 of 22 instructions for forms 1120.

Source: template.net

Source: template.net

Fannie Mae Cash Flow Analysis. W-2 Income from Self-Employment Only add back the eligible Other deductions such as Amortization or Casualty Loss. Fannie Mae Cash Flow Analysis. Our editable auto-calculating worksheets help you to analyze. Interest Income from Self-Employment Line 1 b.

Source: in.pinterest.com

Source: in.pinterest.com

The borrower can document The. The borrower can document The. Some of the worksheets for this concept are 2019 shareholders instructions for schedule k 1 form 1120 s Income tax return for an s corporation omb 1545 Us 1120s line 19 2018 form 1120 w work Fannie mae cash flow analysis calculator Form 91 income calculations calculator Partners adjusted basis work outside basis tax Drake software users manual. This worksheet may be used to prepare a written evaluation of the analysis of income related to self-employment. One or more cells in this workbook contain data validation rules which refer to values on other worksheets.

Source: studylib.net

Source: studylib.net

W-2 Income from Self-Employment Only add back the eligible Other deductions such as Amortization or Casualty Loss. IRS Form 1040 Individual Income Tax Return. Some of the worksheets displayed are 1120 s income tax return for an s corporation 2020 instructions for form 1120 s Fannie mae cash flow analysis calculator Financial aid application work 1 2019 2020 school year Income calculations Fnma self employed income Form 91 income calculator Sam method cash flow analysis work mgic. FNMA B3-321-08 If there is a stable history of receiving the distribution amount consistent with the level of business income needed to qualify then enter this amount on the worksheet and NO further documentation is required to include the income in the borrowers cash flow OR. Interest Income from Self-Employment Line 1 b.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title fannie mae cash flow analysis worksheet by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.